The Archive

Every issue of the Punchbowl News newsletter, including our special editions, right here at your fingertips.

Join the community, and get the morning edition delivered straight to your inbox.

Special Edition

🏦 The Vault: Exclusive: What Yellen told us about Ukraine, Speaker Johnson

Our newest editorial project, in partnership with Google, explores how AI is advancing sectors across the U.S. economy and government through a four-part series.

Check out our first feature focused on AI and energy innovation with Governor Youngkin.

PRESENTED BY

Welcome back to The Vault.

It’s been quite a few weeks — and year — for the global economy.

Bankers have been seriously worried about world politics since February 2022 with the Russian invasion of Ukraine. But the Israel-Hamas war has supercharged the feeling from Wall Street that the global economy’s health is less secure than it has been in decades.

That’s why we sat down with Treasury Secretary Janet Yellen, who has some thoughts about Congress’ role on the world stage these days.

As we’ve written elsewhere, the Treasury Department has spent months trying to convince members of Congress to continue supporting Ukraine’s war effort and humanitarian needs.

But for Yellen, the stakes of this fight — as well as the continuing crisis in the Middle East — are as much about short-term stability as the long-term economic trajectory of the United States and its allies.

In this edition of The Vault, we also take a closer look at the credit card wars. Banks have lobbied hard against the retailer-supported Credit Card Competition Act, but there’s widespread skepticism that the bill could ever pass. Is Wall Street right?

We’ll hear from top bank executives directly this week, when CEOs like JPMorgan Chase’s Jamie Dimon, Citigroup’s Jane Fraser, Wells Fargo’s Charlie Scharf, Goldman Sachs’ David Solomon and more testify before the Senate Banking Committee.

Finally, there’s crypto. This year has been a political rollercoaster for the sector as a long string of scandals continue to mire the industry’s reputation.

Some hoped former FTX CEO Sam Bankman-Fried’s guilty verdict in November would put the crypto-verse’s worst days behind it. Then, the U.S. government smacked international crypto firm Binance with an eye-watering $4 billion fine. We unpack how the sector hopes to drag itself back into Washington’s good graces.

Thanks as always for reading.

— Brendan Pedersen

Sign up to stay in the know with The Vault, Punchbowl News’ pipeline from Washington to Wall Street.

PRESENTED BY GOLDMAN SACHS 10,000 SMALL BUSINESSES VOICES

Tell the Fed: Stop the Squeeze on Small Businesses

If access to capital continues to tighten, 85% of small businesses say it will impact their growth forecast and they may be forced to take these actions:

| → | 67% will have to halt expansion plans. |

| → | 42% will need to cut jobs. |

| → | 21% would close their business. |

THE INTERVIEW

Janet Yellen on Ukraine, deficits and working with Speaker Johnson

More than two years into her job as the Biden administration’s top economic official, Treasury Secretary Janet Yellen must now contend with a House transformed partly by the election of the most conservative speaker in recent memory.

The relationship between Yellen and Speaker Mike Johnson is not off to a banger start.

News: Yellen said she hasn’t spoken to Johnson since he was elected six weeks ago. With all that’s happening in the U.S. economy and abroad, this is a bit of a shocker.

Moreover, the most notable legislative strategy Johnson has employed to date — tying Israel aid to IRS funding cuts — prompted swift condemnation from Yellen in a November address.

“His role is key, and we want to work with him to make sure we deliver for hardworking families,” Yellen told us, referring to Johnson. “I would, however, say that the one thing I was aware of that he did propose, which was cutting funding for the IRS, I would strongly object to. It’s very dangerous.”

Yellen might have the most jam-packed portfolio across all of the Biden administration. The wars raging abroad have only complicated the mix.

Yellen has the unenviable job of securing funds for Ukraine and the Middle East conflict, implementing historic climate and infrastructure investments and reopening economic talks with China. Not to mention, she’s also trying to sell President Joe Biden’s economic agenda to a persistently skeptical public.

A longtime public servant and former chair of the Federal Reserve, Yellen is well-positioned to navigate these challenges. But Congress has not made her job any easier, especially lately.

Ukraine aid: Treasury has directed a full-court press toward Congress in the hopes of shoring up political support for another multi-billion dollar supplemental request for Ukraine.

“They’re bracing for a long winter,” Yellen said of Ukraine. “And this is support that is critical for them to be able to continue to be engaged in the war effort.”

But Yellen’s push comes as support for the war is waning among Republicans. Throughout our conversation, Yellen pointed out that the United States was “not doing this alone,” citing a broad international coalition sending money to Ukraine.

We asked Yellen whether she was concerned this latest supplemental request for Ukraine could be the last Congress approves – if lawmakers can pass it at all. She replied:

“I’m really not going to try to comment on the politics here. But I would say that I do see prominent Republicans like Leader [Mitch] McConnell supporting aid for Ukraine — military and economic — and we have made commitments to our allies. This is something we’re doing jointly. I want to make sure they get the aid they need.”

For Yellen, the goal is to send “critical” funding for broader economic aid, not just military backing.

“Ukraine is currently spending every penny or more that it takes in revenue for military purposes, to support its war effort,” Yellen said. “So we’re filling in money that they need for government functions like hospitals, first responders, school teachers.”

The deficit: Yellen acknowledged a shifting financial environment could force policymakers to grapple with the economic effects of the United States’ $33 trillion national debt more quickly.

Interest rates are up. And recent stress in the bond market, coupled with yields near historic highs, has left policymakers wondering whether federal payments on U.S. debt could soon introduce a real drag to the economy’s long-term growth. The United States spent $659 billion on bondholder payments in FY2023, nearly double FY2020’s total of $345 billion.

Yellen argued the Biden administration is taking the deficit seriously, citing budget proposals that would reduce the deficit by a few trillion dollars over the next 10 years.

But also she said a persistent elevation in interest rates would create “a somewhat greater challenge” for policymakers.

“Additional deficit reduction is appropriate,” Yellen said. “The president has proposed that and would stand ready to work with Congress to look for ways to enact that.”

Stablecoins: Yellen echoed concerns from congressional Democrats about one of the key planks of House Republicans’ approach to crypto reform. For years now, the Treasury secretary has asked Congress to pass legislation regulating stablecoins, arguing the product could pose unique financial stability risks.

But Yellen told us it was vital for the federal government to play an oversight role. The Republican approach would limit the Federal Reserve’s direct supervision over state-chartered stablecoin companies.

“It’s critical that the federal government essentially has a role in providing a floor for what is an acceptable state of regulation with respect to stablecoins. I’m not comfortable with the idea of only state regulation and no federal role,” Yellen said.

Lawmakers supportive of the House’s stablecoin bill say it introduces a federal floor. But opponents have argued there are outstanding questions about how those standards would be enforced by state authorities.

Big fiscal: Debt concerns notwithstanding, Yellen said she was increasingly sure the Biden administration’s “go big” fiscal response to the pandemic was the right approach.

There’s been a lot of debate in Washington about whether federal spending in 2020 and 2021 fueled inflation in 2022. Yellen thinks recent economic developments are evidence that inflation was truly transitory.

Yellen told us she believed the American Rescue Plan was the correct response and that the recent dropoff in inflation figures has made her “feel more confident” about that assessment.

“Americans are of course suffering from higher prices than before the pandemic, but prices are stabilizing. Inflation has come down. We addressed what could have been things that resulted in tremendous scarring.”

— Brendan Pedersen

MAIN STREET X WALL STREET

The political viewer’s guide to Washington’s credit card wars

One of Washington’s fiercest lobbying fights might reach a breaking point this winter as retailers and banks take their credit card wars to the hallways of Congress. And no one quite knows which side lawmakers will pick.

The two sectors are at loggerheads over the Credit Card Competition Act, a package backed by the merchant and retail lobby that takes aim at credit card fees. Banks aren’t pleased. Card fees are among their most lucrative sources of profit.

One bit of good news for the banking sector – the airline industry and several of its unions have also come out hard against credit card reform, partly due to concerns about the bill’s potential impact on reward programs.

But backers of the credit card bill hope the Senate can slide it into its already jam-packed end-of-year schedule that includes potential votes on a supplemental national security package and the NDAA.

“I’m as motivated as ever. I think to some extent, our strategy depends on what bills are put on the floor here,” said Sen. Roger Marshall (R-Kan.), the lead Republican cosponsor.

Marshall suggested the SAFER Banking Act as another potential avenue. Senate Majority Leader Chuck Schumer has promised to put the cannabis reform bill on the floor, but that likely won’t happen until next year at the earliest.

“We thought the SAFE Banking Act was a good vehicle, and it just looks like we’re getting less and less work done around here. So our strategy depends on what goes on the floor,” Marshall said.

But the lead Democrat on the bill, Senate Majority Whip Dick Durbin, had a less rosy outlook. Durbin told us the credit card proposal riding on any must-pass year-end deals was “a long shot.”

“We have a limited agenda and an even more limited amount of time,” Durbin said.

Even with dim prospects for passage right now, the banking and retail sectors are gearing up for a legislative brawl with billions of dollars on the line.

Here are the key groups to watch as the credit card war plays out.

The merchants: Doug Kantor, general counsel at the National Association of Convenience Stores; Stephanie Martz, chief administrative officer and general counsel at the National Retail Federation and Jennifer Hatcher, chief public policy officer and senior vice president of government and public affairs at the Food Marketing Institute.

Kantor is one of Washington’s longest-serving fighters in the credit card wars, pushing for card reforms and lobbying congressional staff since before Dodd-Frank. Martz leads swipe fee strategy for the country’s single largest merchant lobby organization, while Hatcher represents food and grocery retailers, specifically.

Merchant supporters: Sens. Durbin, Marshall and Peter Welch (D-Vt.).

Durbin is one of the retail sector’s most stalwart allies in this fight. As chair of the Senate Judiciary Committee, he’s focused on the antitrust implications behind Mastercard-Visa’s market dominance.

Marshall is a recent recruit who has energized merchant supporters with a hard-charging style. The Kansas Republican has already threatened to hold up multiple Senate bills unless there’s a commitment from leadership to vote on the CCCA. Welch, meanwhile, has been a big supporter of this cause since his days in the House.

The bankers: Richard Hunt, executive chair of the Electronic Payments Coalition; James Ballentine, founder of the lobbying firm Ballentine Strategies and former head of congressional relations for the American Bankers Association; and Pace Bradshaw, senior vice president and head of U.S. government engagement at Visa.

Hunt has an operator’s reputation in financial circles. Before joining the EPC, he helped transform the Consumer Bankers Association from a sleepy trade group into a formidable force in the retail banking space.

Ballentine led government affairs for the nation’s largest bank lobby for more than two decades and now runs his own practice. Bradshaw, as Visa’s top lobbyist, has played a prominent role in crafting the credit card lobby’s strategy.

Banking backers: Rep. Patrick McHenry (R-N.C.), Rep. Blaine Luetkemeyer (R-Mo.) and Sen. Jon Tester (D-Mont.).

Tester has been an ally of banks in this fight dating back to his House days. That’s partly because of his strong relationships with community banks. McHenry and Luetkemeyer are staunchly opposed to the reform. McHenry is chair of the House Financial Services Committee, and Luetkemeyer is a senior lawmaker on the panel and a former banker himself.

The X factor: A vote on the Credit Card Competition Act would force lawmakers to pick a side between two of Washington’s most powerful interests, with hundreds of billions of dollars at stake.

But there’s one problem: Congress hasn’t voted on this issue since the last-minute inclusion of an amendment capping interchange fees for debit card transactions during the 2010 Dodd-Frank financial reform negotiations. That leaves key groups in the dark about where many lawmakers stand.

“There is a ton of uncertainty, whether it’s from the retailers or from the credit card companies and banks, as to where everybody is on this,” one lobbyist told us.

— Brendan Pedersen

PRESENTED BY GOLDMAN SACHS 10,000 SMALL BUSINESSES VOICES

Only 29% of small business owners can afford to take out a loan given current interest rates.

Small business owner Dr. Shantell Chambliss, CEO of Nonprofitability in Richmond, VA: “It’s not that we’ve been denied, it’s that the terms would hurt our business more than help.”

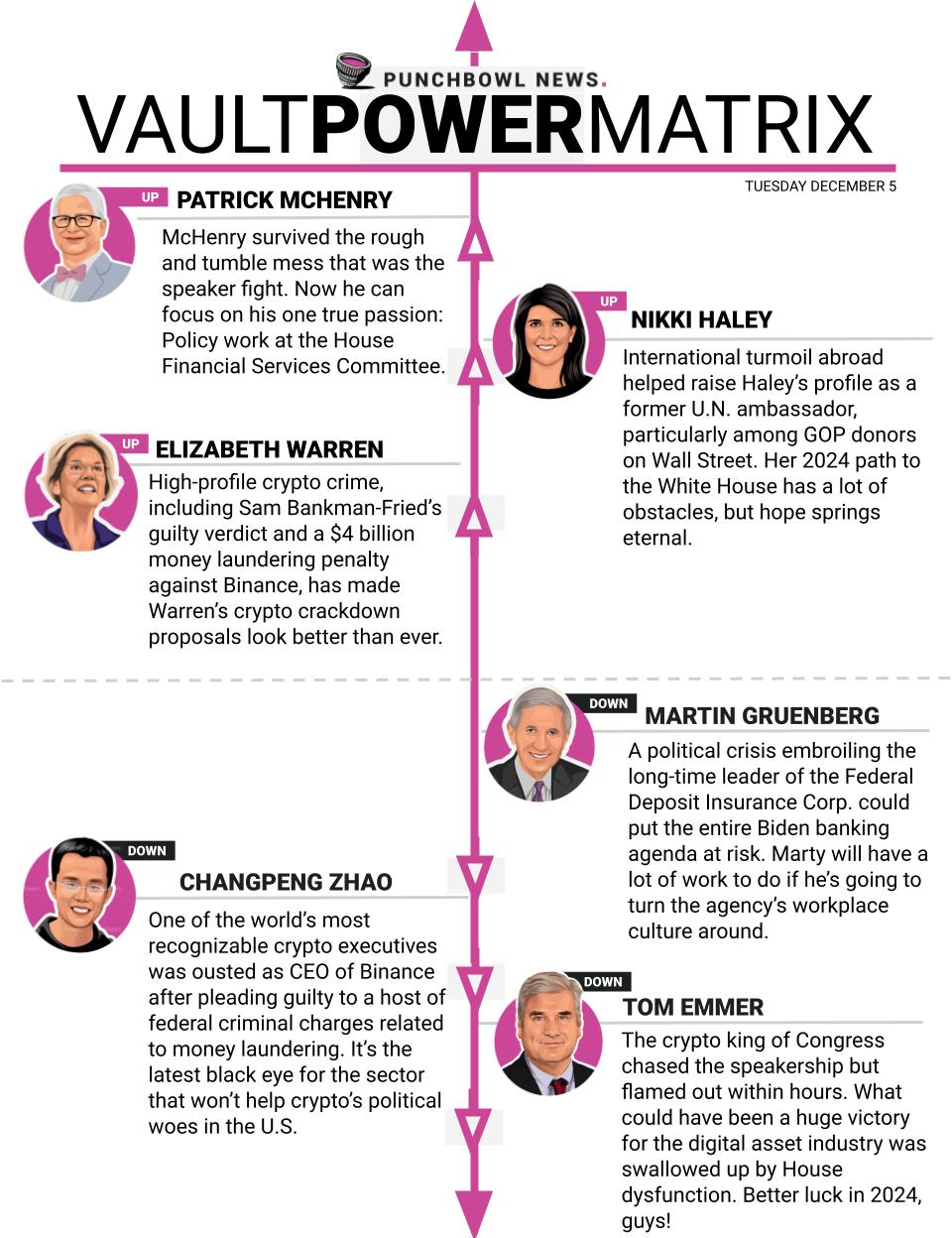

VAULT POWER MATRIX

— Brendan Pedersen

DIGITAL DOWNLOAD

Glimpses of hope for crypto in 2024 after a year in the wilderness

Crypto has had a rough 2023, to say the least. But advocates say 2024 is fertile for a turnaround, partly with the help of a changing Congress and some potential court wins in the pipeline.

Any political upswing for crypto could carry significant implications for the financial system and the rules used to regulate it. Large-scale reforms are still a legislative longshot but not impossible.

Just over a year ago, America’s preeminent crypto exchange FTX collapsed, driven by a cesspool of fraud. The industry’s political goodwill in Washington disintegrated almost simultaneously and hasn’t fully recovered.

But the crypto sector has also shown a real capacity for forging and maintaining powerful relationships in the nation’s capital. House Majority Whip Tom Emmer, who nearly became speaker back in October, has long been one of crypto’s strongest backers on the Hill.

And just last week, amid negotiations over annual defense authorization policy between the House and Senate, Rep. Patrick McHenry (R-N.C.) threw his political weight behind an industry-backed bill that would change the market structure of crypto regulation. The standoff likely means financial policy from the Senate will get stripped from the final NDAA.

“Those in Congress who really recognize both the value of the technology and also the fact that it’s here to stay not just in the United States but globally — they never really took their foot off the gas,” said Brett Quick, head of government affairs at the Crypto Council for Innovation.

The 2024 election could also usher in a friendlier cadre of lawmakers as Congress appears to be on track for a historic number of member retirements. That means while Capitol Hill might seem chilly to crypto today, new members could shift political calculus in 2025.

Hopes hang on the judiciary: The industry has vested lots of hope in the courts next year. Challenging policy and enforcement actions from the Securities and Exchange Commission has been a top focus for crypto for years now. While the government still wins a lot more cases than not, some could yield real wins for crypto.

One closely tracked case revolved around the crypto company Grayscale, which spent several years trying to get SEC approval to offer a Bitcoin-centric ETF. The District of Columbia Court of Appeals eventually sided with Grayscale, directing the SEC to fully consider — though not necessarily approve — the company’s application.

There are other major lawsuits working through the courts right now between the SEC and U.S. companies like Coinbase and Kraken, where the government has accused crypto firms of selling “unregistered” securities. The outcomes of those cases, closely watched by many in Congress, could send huge ripples through crypto’s legal landscape.

Speaking of Capitol Hill: Even folks who have benefited from crypto’s legal wins lately say it’s not a sustainable political approach without Congress.

“I don’t think litigation is a long-term solution,” said Craig Salm, chief legal officer at Grayscale. “It’s a way to get clarity. Now I think Congress, in the long term, is the way we will get clarity around classification of digital assets.”

To be clear, the sector is by no means out of the woods. Plenty of lawmakers have deep concerns about crypto’s role in global money laundering, particularly after the Oct. 7 attack on Israel. And additional high-profile crypto executives facing criminal prosecution for money laundering-related crimes — this time, with Binance’s former CEO Changpeng Zhao — won’t alleviate any pressure.

Senate Banking Committee Chair Sherrod Brown (D-Ohio) has been exploring legislation to bolster anti-money laundering requirements among crypto firms. He’s a close ally of Sen. Elizabeth Warren (D-Mass.), who is pushing an anti-money laundering bill reviled by the industry.

“We have crypto bills in the Senate that we’re going to work through and some pretty good policy,” Brown told us.

— Brendan Pedersen

PRESENTED BY GOLDMAN SACHS 10,000 SMALL BUSINESSES VOICES

Tell the Fed: Stop the Squeeze on Small Businesses

The Fed’s proposed bank capital requirements will make it harder for minority-owned businesses to access capital.

| → |

| → | Only 26% of Black small business owners that applied for business loans or credit in the past year received their requested funding amount. |

“The capital that I’ve been able to secure was very expensive,” says Ceata Lash, CEO of PuffCuff in Marietta, GA. “And now I’m paying for it.”

Editorial photos provided by Getty Images. Political ads courtesy of AdImpact.

Crucial Capitol Hill news AM, Midday, and PM—5 times a week

Join a community of some of the most powerful people in Washington and beyond. Exclusive newsmaker events, parties, in-person and virtual briefings and more.

Subscribe to Premium

The Canvass Year-End Report

And what senior aides and downtown figures believe will happen in 2023.

Check it outEvery single issue of Punchbowl News published, all in one place

Visit the archiveOur newest editorial project, in partnership with Google, explores how AI is advancing sectors across the U.S. economy and government through a four-part series.

Check out our first feature focused on AI and energy innovation with Governor Youngkin.