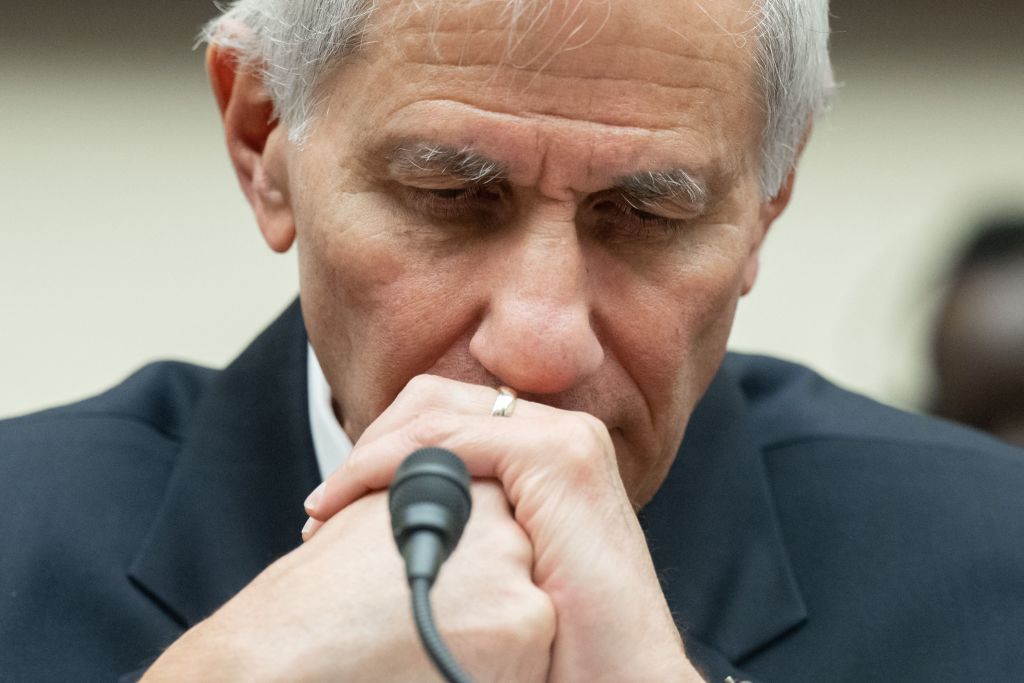

We’re one day away from federal bank regulators arriving on Capitol Hill to testify publicly. We already know much of the focus will be on Federal Deposit Insurance Corp. Chair Martin Gruenberg, and his performance could determine whether he keeps that job.

In the interim, Washington is doing what it does best: speculating about who could come next. If Gruenberg does step aside, the Biden administration will need to move quickly to find a replacement if it wants to try to salvage Democrats’ financial policy agenda.

Senate nominations are never exactly easy. But this one would be particularly difficult.

The timing: We’re less than six months away from a presidential election. A potential change in White House control being just around the corner will make finding someone willing to take the job that much harder.

The chair of the FDIC is technically an “independent” role with some protection from being fired without cause. Senate-confirmed chairs are given a five-year term, so it’s always a possibility that a regulator will start their tenure under one president and finish it under another.

But in reality, the politics around FDIC leadership have become much more partisan since the Trump administration. Congressional Republicans still haven’t forgiven Democrats for what they called a coup targeting former FDIC Chair Jelena McWilliams, who resigned from the agency in late 2021.

And even if a replacement nomination to lead the FDIC came together quickly, the confirmation process would still take time. How many would-be FDIC chairs would want to endure that process, serve two months in the role, only to have a Republican White House try to fire them in late January? That is a short, short list.

The task: Not a lot of kids grow up dreaming of being the FDIC chair. That makes it a tough role to fill in a pinch, regardless of the circumstances.

The group gets considerably smaller when you consider that most people qualified to lead a federal bank regulator could get paid a lot more in the private sector.

But even setting technical expertise aside, the FDIC’s current crisis will also put a premium on management experience. The roughly 6,000-strong agency is in dire need of transformation. A potential nominee would have to convince the Senate they’re prepared to make those changes happen.

Speaking of lists: There’s a handful of folks that bank lobbyists and other insiders could imagine being under White House consideration for this job.

That includes New York Department of Financial Services Superintendent Adrienne Harris, former Deputy Director of the White House National Economic Council Bharat Ramamurti, former Assistant Treasury Secretary for Financial Institutions Graham Steele and University of California-Irvine Professor Mehrsa Baradaran.

Again: It’s going to be tough to get any of these folks through the vetting and confirmation process anytime soon. If Democrats want to finish much of their financial agenda this year, they might have to hope Gruenberg can hang on tight.